Federal unemployment withholding calculator

Youll need your most recent pay stubs and income tax return. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand.

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee.

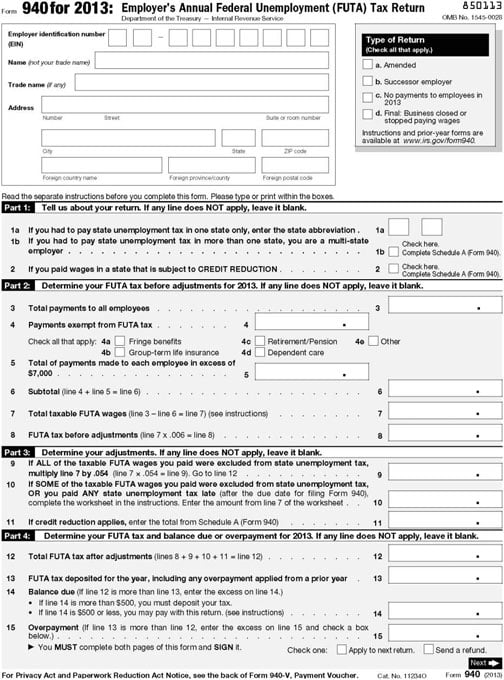

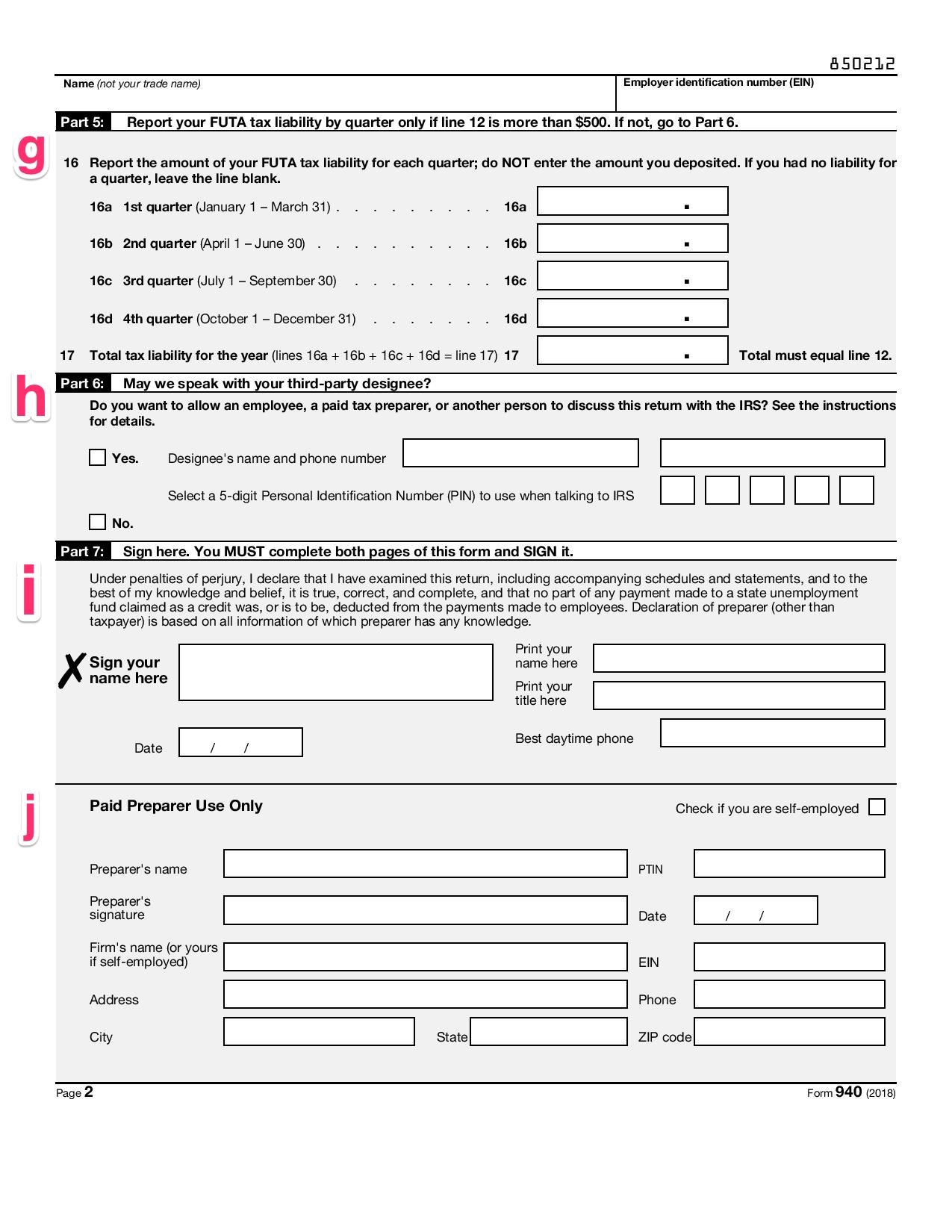

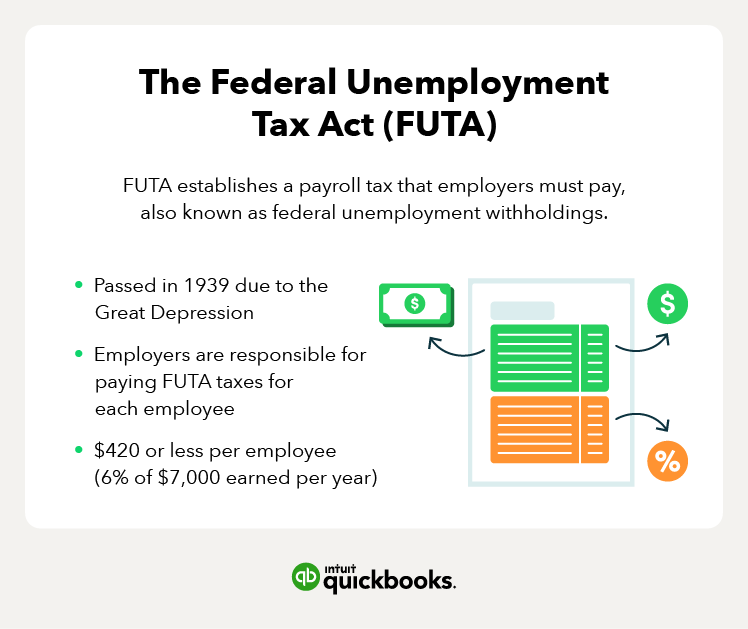

. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. The first 7000 for each employee will be the taxable wage base limit for. If your company is required to pay into a state unemployment fund you may be eligible for a tax.

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that. This Estimator is integrated with a W-4 Form.

The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year. For unemployment insurance information call 617 626. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

The IRS hosts a withholding calculator online tool which can be found on their website. Use this tool to. Estimate your paycheck withholding with our free W-4 Withholding Calculator.

Estimate your federal income tax withholding. Contacting the Department of Unemployment Assistance to fulfill obligations for state employment security taxes. If youve paid the state unemployment taxes you can take a credit of up to 54.

The tax rate is 6 of the first 7000 of taxable income an employee earns annually. This number is the gross pay per pay period. Under the American Rescue Plan signed into law Thursday the IRS will make the first 10200 in unemployment benefits from 2020 tax-free.

You exceed 12000 in withholding during a quarter it is your responsibility to begin to pay your Illinois withholding income tax semi-weekly in the following quarter the remainder of the year. Use that information to update your income tax withholding elections on our Services Online retirement. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income.

See how your refund take-home pay or tax due are affected by withholding amount. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The 2017 federal unemployment tax is 6 of the first 7000 you pay in wages to an employee.

Subtract any deductions and.

Financial Accounting Payroll In 2022 Financial Accounting Accounting Classes Payroll

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Fill Out Irs Form 940 Futa Tax Return Youtube

Guidelines For Loading Us Federal Taxes Card Components

Federal Income Tax Fit Payroll Tax Calculation Youtube

Calculating Employer Payroll Taxes Youtube

How To Calculate Unemployment Tax Futa Dummies

Accountants Are In The Past Managers Are In The Present And Leaders Are In The Future Accounting Services Accounting And Finance Financial Management

Futa Tax Overview How It Works How To Calculate

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Templates

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

How To Fill Out Form 940 Futa Tax Return Youtube

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube

Rules To Do An Ira Qualified Charitable Distribution Charitable Financial Management Ira

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks